With only five weeks left in the Legislative Session, tax issues are heating up. One of the key tax issues for business this year, and the top priority for the Minnesota Chamber of Commerce, is to reduce the impact of the statewide business property tax.

With only five weeks left in the Legislative Session, tax issues are heating up. One of the key tax issues for business this year, and the top priority for the Minnesota Chamber of Commerce, is to reduce the impact of the statewide business property tax.

Greater Mankato Growth strives to keep our businesses up-to-speed on key issues at the Legislature so that they can weigh-in and be their own best advocate on issues that are of interest to them. The statewide business property tax impacts every commercial and industrial property in the state, so you’ll want to check out the information below. Be sure to make your voice heard with our regional legislators with your thoughts on this issue.

Statewide Business Property Tax information

Like homeowners and farmers, businesses in Minnesota pay local property taxes to the school, county and city. Unlike homeowners and farmers, businesses in Minnesota also pay an additional state property tax that goes to the state’s general fund.

The statewide business property tax began in 2002 and in its first year collected $585. The tax, which increases automatically with inflation each year, now collects more than $850 million and accounts for about 30% of a business’s total property tax bill.

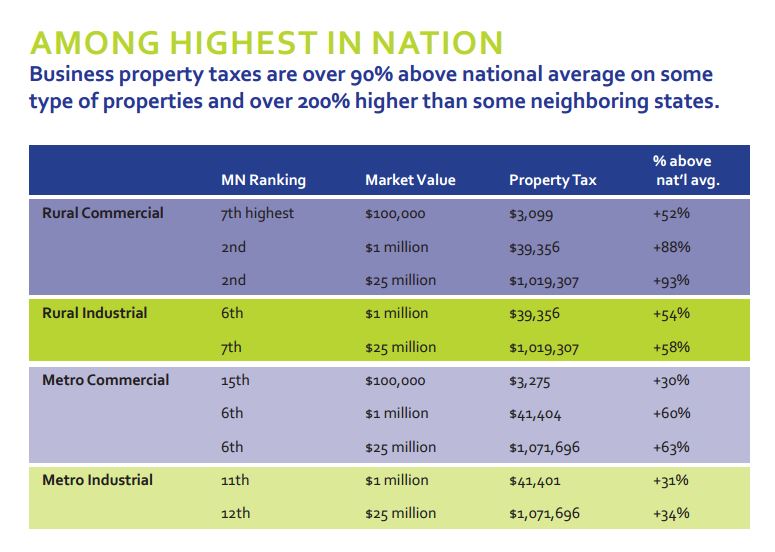

This has led Minnesota business property taxes to be among the highest in the nation. As the chart below shows, tax burdens on some properties are more than 90% higher than the national average and more than 200% higher than neighboring states. Further, businesses pay a disproportionate share of the property tax; they have 12% of the market value but pay 32% of the total property tax.

Chart Courtesy of United for Jobs Minnesota

The Minnesota Chamber, Greater Minnesota Partnership and other organizations are advocating a reduction in the statewide business property tax levy (not a full repeal). At minimum, they would like to stop the automatic inflation of the tax each year (which increases the levy about $40 million/year).

You can get more information on the statewide business property tax issue 这里. Also be sure to weigh-in with our regional legislators with your thoughts on this issue 这里.