Going into the 2023 legislative session, expectations were high, and everyone was curious of how the new legislative trifecta would impact the session. That curiosity quickly evaporated as the DFL sprinted out of the gate fast and never let off the gas. This past session will be remembered for decades to come. Not only was there a record surplus of $17.5 billion, but there were also records set for the most legislative days (75), most bills introduced (3,336 in the House and 3,356 in the Senate), committee hearings (reports) early in session. More importantly, there was a (nearly) unwavering collective effort of the House and Senate DFL of sticking together on major legislation.

Legislators remained in St. Paul until the very last day of the session, adjourning with just a couple hours to spare before the constitutionally-required adjournment. In the end, the budget for the next biennium is $72 billion, a 38% increase from the current biennium budget of $52 billion. However, much of that spending is one-time money. A $1.5 billion bonding bill was passed, with an additional $1billion in cash for other projects. Only a few Minnesotans will see some of the surplus come back to them in the form of a tax rebate. There were historic investments in K-12 education, higher education, housing, nursing homes, public safety, transportation, and much more.

Governor Tim Walz at a budget signing ceremony with Lieutenant Governor Peggy Flannagan, First Lady Gwen Walz, and legislative leaders on May 24, 2023. Shown left to right: Lieutenant Governor Peggy Flannagan (DFL), Senate President Bobby Joe Champion (DFL – Minneapolis), Governor Tim Walz (DFL), Gwen Walz, Speaker of the House Melissa Hortman (DFL – Brooklyn Park), and Senate Majority Leader Kari Dziedzic (DFL – Minneapolis). (Photo credit: Copyright Office of Governor Tim Walz and Lieutenant Governor Peggy Flannagan.)

Workforce Development

Explore Minnesota for Business, along with Explore Minnesota Tourism, received $67 million in the biennium (a $33 million increase in the base funding). To help fulfill its mission of promoting overall livability and workforce and economic opportunity in Minnesota, Explore Minnesota Business will be advised by a Council (appointed by the Governor), which includes an at-large spot for economic development officials.

A significant piece of higher education legislation passed this year. The “North Star Promise Program” provides free tuition to public colleges and universities in Minnesota for students with a household income of less than $80,000 per year. The program will cost Minnesota taxpayers roughly $50 million annually and impact about 15,000 students. The average award is expected to be about $3,100. This program could make Minnesota colleges and universities more attractive in a highly competitive regional and global marketplace. Greater Mankato has tremendous public educational resources, including Minnesota State University, Mankato (the second largest university in Minnesota) and South Central College.

The Drive for 5 Workforce Fund, a budget priority proposed by Governor Walz, passed into law allocating $10 million for programs designed to prepare a workforce in five of the most critical occupational categories in the state with “high-growth jobs and family-sustaining wages”: technology, labor, caring professionals, manufacturing, and educational professional services. The program creates a competitive grant process in which organizations throughout the state can apply for funds.

One of the key policy priorities of the legislature was to allow undocumented workers to obtain a driver’s license. Prior to 2003, it was legal for non-citizens to obtain a driver’s license in Minnesota, making it easier for companies throughout Minnesota to rely on immigrant workers, which was especially true in southern Minnesota, where we are home to significant agricultural resources. A large coalition of groups supported the Drivers License for All legislation, including law enforcement, faith, business, and immigrant rights groups. The Minnesota Chamber of Commerce vocally supported the bill, sharing that allowing immigrant workers to obtain a drivers license “will make roads safer for all drivers and further enhance the work and community contributions of immigrant workers.“

Tax Competitiveness

Paid Family Leave (PFML), a key priority for the DFL for many years, passed this session. The new program takes effect on January 1, 2026 and will allow workers to take up 12 weeks of paid time off for a severe medical condition and up to 12 weeks to care for family members with serious illness or to bond with a new child. The benefits are capped at 20 weeks in a year and workers receive partial wage replacement. The program is funded by a payroll tax of 0.7% and can be split evenly between employers and workers. The bill includes a wage exclusion, which allows employers with fewer than 30 employees to pay a lower premium. It also provides funding for grants to small businesses for temporary workers.

The $3 billion tax package included many credits and refunds but didn’t cut any tax rates. Refunds will be sent to many Minnesotans. Individual taxpayers making less than $75,000 annually will receive $260, married filers making less than $150,000 will receive $520, plus an additional $260 per child.

Local Government Aid (LGA) received an increase of $80 million. LGA is state aid to cities that helps restrain local property taxes, especially on commercial and industrial properties, while ensuring that communities can afford necessary public services.

Beyond the credits and refunds, there was nearly $9 billion in additional revenue in the final budget bills over the next two biennium. This includes a 0.75% metro sales tax for transportation, increased tab fees and gas tax, a new $0.50 tax on deliveries from online retailers, and a new 0.25% metro sales tax for housing, to name a few.

Post-Session Legislative Forum held on May 24, 2023 at South Central College. From left to right: Representative Luke Frederick (DFL – Mankato), Representative Jeff Brand (DFL – St. Peter), Senator Rich Draheim (R – Madison Lake), Senator Nick Frentz (DFL – North Mankato), and Andy Wilke (GMG).

Healthcare

A key part of the final budget negotiations included $300 million for a nursing home incentive grant program. This will provide direct payments to nursing homes for covering debt payments and lines of credit, a nursing home temporary rate add-on, and partial reimbursement to hospitals for qualifying avoidable patient delays.

MinnesotaCare eligibility was expanded to include coverage for undocumented individuals. The bill also directs the Commissioner of Health and Human Services to complete an actuarial and economic analysis for a MinnesotaCare public buy-in implementation plan. The legislation sets forth a path to make a public, buy-in option available by January 1, 2027. Further, the bill will study the costs associated with a universal health care coverage program.

A nurse staffing bill was a flash point at the end of the session. The “Keeping Nurses at the Bedside Act” passed both chambers and a conference report was adopted. Last minute concerns about that bill from healthcare providers, led by the Mayo Clinic, resulted in the bill returning to conference committee. The final bill, “Nurse and Patient Safety Act”, was passed and signed into law by Governor Walz. The modified bill aimed to improve safety concerns, but excluded the creation of nurse staffing committees, which would have set staffing ratios for each facility.

Childcare

The Department of Employment and Economic Development (DEED) received $13 million for Economic Development Child Care Grants. These grants support a wide variety of projects that work to reduce the childcare shortage in our communities. At least half of these funds will support projects in Greater Minnesota.

The six Minnesota Initiative Foundations received a total of $7 million to support their child care efforts. They serve all 80 counties in Greater Minnesota and support their individual regions in building economic prosperity by providing grants, business loans, and programming. Each foundation has been deeply involved in addressing Greater Minnesota’s childcare crisis, and these funds will help expand the scope and reach of their work.

The Child Care Assistance Program (CCAP) reimbursement rate was increased. As identified in a recent report by the Center for Rural Policy and Development, the state’s lack of investment in CCAP has been a significant contributor to childcare shortages in Greater Minnesota. The legislation passed this session will increase the CCAP reimbursement rate from its current level of about 30-35 percent to 75 percent of the local childcare provider market rate. Providers who used to get about 30 cents on the dollar will now get reimbursed at 75 cents on the dollar for CCAP-eligible families. This will have a significant impact on the ability of childcare providers to build sustainable and financially stable businesses.

The Office of Child Care Community Partnerships was established. An initiative of Governor Walz, this new office will serve as a conduit between community leaders—local governments, businesses, and nonprofits—who are looking to support the expansion of their local childcare capacity. The office will help connect local leaders with the resources needed to make the projects successful, as well as other state agencies that can provide financial and technical resources.

Andy Wilke, Executive Vice President, testifies before the House Workforce Committee on January 12, 2023 on HF2 – Paid Family and Medical Leave. He encouraged the legislature to work with all stakeholders to find a workable plan that doesn’t hurt employers, particularly small businesses.

Transportation

The final transportation bill will provide the largest influx of new infrastructure funding in over a decade, providing funds to match federal infrastructure dollars, increases for transit funding, and including several new sources of revenue. The bill increases the metro area sales tax by 0.75% for transit, indexes the gas tax to inflation, imposes a 50-cent fee on certain deliveries over $100, increases motor vehicle tab fees by modifying the fee schedule, and dedicates a portion of the sales tax on motor vehicle parts to transportation purposed. The bill makes several policy changes, funds the rail line from the Twin Cities to Duluth, and provides rebates for electric bike purchases.

Bonding

There were several projects that received state bonding dollars, including: $35 million for the City of Mankato’s wastewater treatment facility, $8.46 million for Minnesota State University, Mankato’s Armstrong Hall phase 1, $4.5 million for the Bureau of Criminal Apprehension for a Southern Minnesota Office and Laboratory, and $22 million for the St. Peter Regional Treatment Facility.

GreenSeam

GreenSeam will receive $200,000 over the next two years which is an increased amount of funding from each of the past three biennium.

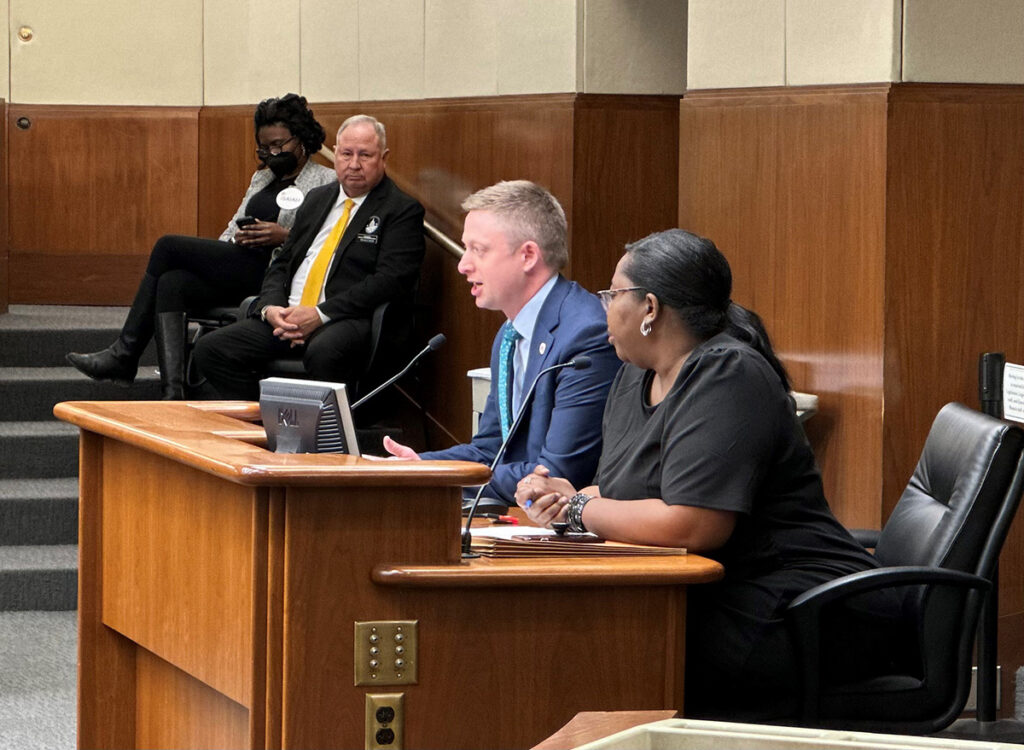

Senator Nick Frentz, chief author of the GreenSeam funding bill, testifies before the Senate Agriculture Committee. He is joined by Sam Ziegler (far right), Director of GreenSeam.

Economic Development

The Redevelopment Grant Program will receive $4.26 million. The final bill language also increased flexibility for the Commissioner to be able to transfer funds from the Job Creation Fund to the Redevelopment Program, in addition to the Minnesota Investment Fund transfer authority that already exists.

The Minnesota Forward Fund is a new initiative that allocates $500 million for matching funds used to secure and leverage federal investments in infrastructure and large-scale economic development projects in existing, new, and emerging industries. The Fund can be used in the form of loans or grants directly to businesses or municipalities for qualifying projects.

The Business Development Public Infrastructure (BDPI) Program received $14.5 million. BDPI provides grants to cities in Greater Minnesota to cover up to 50 percent of the capital costs for the public infrastructure necessary to expand economic development, or to retain or create jobs. Typically, this funding is used for the development or expansion of industrial parks.

The Border-to-Border Broadband Grant program received $125 million. These grants help cover the cost of the broadband infrastructure needed to connect businesses and homes to internet service that meets the state goal of 100 mbps upload and 20 mbps download speeds. With the vast majority of Twin Cities properties already meeting the 2026 benchmark, these funds will mostly support projects in Greater Minnesota.

What’s Next

The full extent of this past session is still being determined. There is a number of provisions that are still being reviewed. In fact, it was reported on July 7 that there is an error in the tax bill that could cost Minnesota taxpayers upwards of $350 million.

Greater Mankato Growth will be engaging with our members for the remainder of this year to better understand how many of these changes will affect their businesses. Later this fall, a policy survey will go out to all members. Once the results of that survey are received, the GMG Advocacy Committee will start drafting the 2024 policy priorities. The GMG board of directors will review and approve the policy priorities prior to the start of the 2024 legislative session, which starts on February 12, 2024.

If you have any questions, or would like additional details on the 2023 legislative session or the GMG policy priorities, reach out to Andy Wilke, Executive Vice President of Greater Mankato Growth.