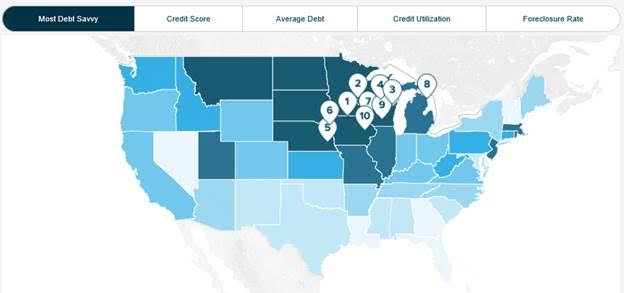

Mankato was recently identified by SmartAsset.com as the most debt savvy location in the country. A debt savvy location means people there have high credit scores, low average personal loan debt, low credit utilization and low mortgage foreclosure rates.

The study aims to find the placeswhere people are the smartest when it comes to debt. To find these debt savvy places they looked at four factors: credit score, average personal loan debt, credit utilization and mortgage foreclosure rate.

To calculate the Debt Savvy Index, all four factors were weighted equally. The cities were ranked on each of the categories and then each category was indexed. Those indices were then added together and indexed.

Looking at the factors, Mankato has the highest average credit score and the 10th lowest Foreclosure Rate in the nation. This paints a picture of a community that has lots of potential purchasing power, economic strength & sustainability, and many ethical financial institutions. A community that is a national credit score leader doesn’t have slum and blight, but instead very strong neighborhoods. A community with a low foreclosure rate has an intelligent responsible workforce. Our low unemployment rate would align with this study. A high rate of residents have jobs, so they can pay their bills in a timely fashion.

Give yourselves a pat on the back Mankato. You handle your business.